Who This Is For

Built for Institutional Investment and Capital Management

Acumentica is designed for hedge funds, asset managers, CIOs, and institutional investors who require disciplined capital control, downside protection, and adaptive decision systems under uncertainty.

If your capital must be governed; not guessed; this system fits.

Funds, RIAs & Family Offices

Scale discipline across mandates

Protect capital during regime shifts

Replace ad-hoc judgment with structure

CIO’s & Risk Leaders

Enforce consistent decision rules

Reduce behavioral risk and policy drift

Maintain governance across portfolios and teams

Portfolio Managers

Keep your edge without over-trading

Press when conditions support it

Stand down when the probability of error rises

Research Analyst

Accelerate multi-signal research

Validate insights against risk and constraints

Produce clear, audit-ready rationales

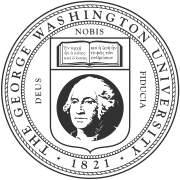

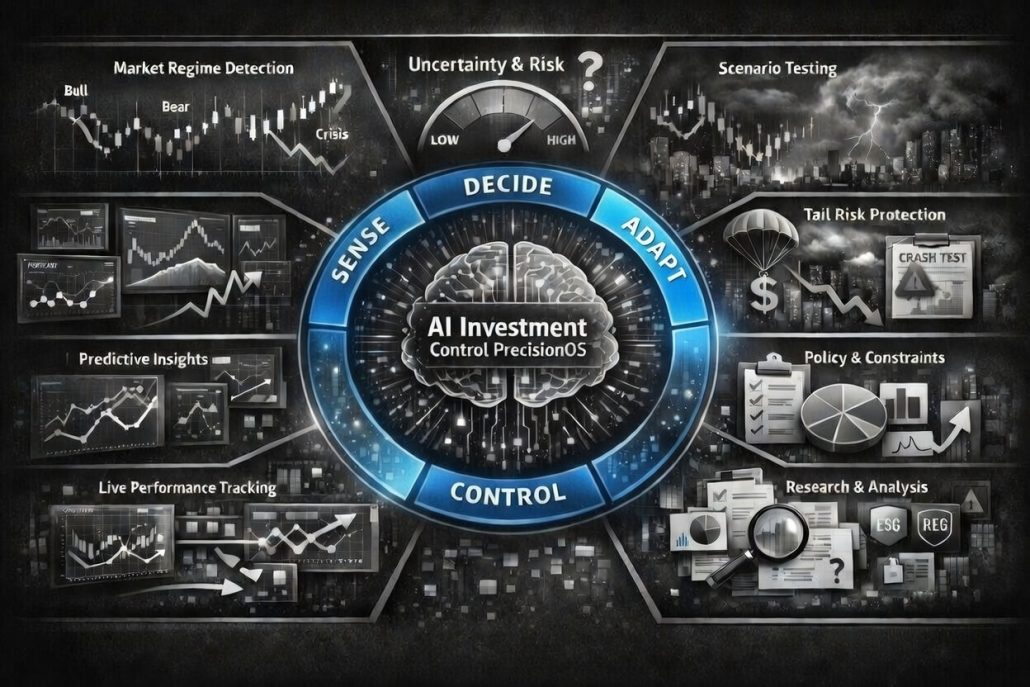

How It Works

Acumentica connects market intelligence, portfolio optimization, and risk control into a single closed-loop decision system.

The system continuously evaluates market conditions, determines appropriate portfolio actions under defined constraints, and adapts as outcomes unfold; ensuring decisions remain disciplined, auditable, and aligned with mandates.

What Makes Us Different?

Your Investment GROWTH Is Our Success

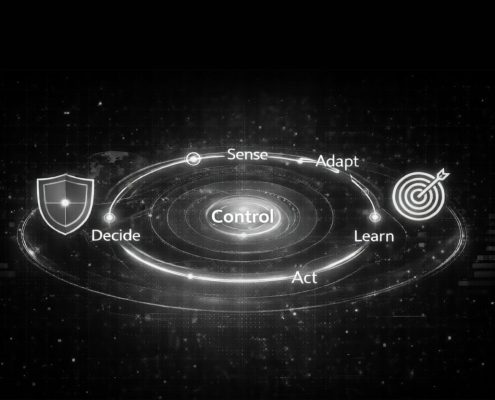

Decision Control System

Acumentica is engineered as an investment decision control system—not an analytics, insight, or signal platform.

While traditional platforms inform decisions, Acumentica governs how decisions are made by ensuring that every portfolio action:

Is based on a unified view of market, regime, and risk conditions

Is evaluated against explicit risk, policy, and mandate constraints

Is executed with precision and accountability

Adapts over time as real market outcomes unfold

This approach replaces fragmented analysis and reactive judgment with controlled, traceable, and disciplined decision-making; by design.

We Solve The Hardest Problem In Investing: Staying Inside the Rules

Catalyze forward from gaining insights to achieving CONTROL

By governing decisions inside explicit rules, Acumentica helps teams move from insight to controlled action; without sacrificing discipline.

Experience Investment Control

Your Strategy Deserves Precision

See how Acumentica helps investment teams forecast markets, optimize portfolios, and govern decisions within defined risk and mandate constraints.

AGI Investment Research Labs

Where Investment Ideas Shape Tomorrow.